Founder-led magic can build a cult brand, but operator-led scaling is what turns premium athleisure into a durable growth engine. For yogipreneurs tracking category leaders, the leadership shift at Beyond Yoga is a signal about ownership dynamics, portfolio priorities, and what comes next for distribution, retail footprint, and brand positioning. You’ll get a clear, fact-checked read on the current chief executive, the transition from the founder era, and how the new leader’s track record in women’s activewear could influence everything from Beyond Yoga leggings to category expansion like Beyond Yoga maternity clothes. Here’s what you need to know about the Beyond Yoga CEO.

Table of Contents

- 1 Beyond Yoga CEO: Who Leads the Brand Today

- 2 When Did Nancy Green Become CEO of Beyond Yoga?

- 3 Beyond Yoga New CEO: Nancy Green’s Background and Track Record

- 4 Michelle Wahler and the Founder Era: What Changed (and What Didn’t)

- 5 Who Owns Beyond Yoga? Ownership, Acquisition, and Control

- 6 What Nancy Green’s Appointment Signals About Levi’s Strategy (Content Gap / Hidden Insight)

- 7 Growth Strategy Under the Beyond Yoga CEO: Where Expansion May Show Up

- 8 Brand Positioning: Premium, Body-Positive, Inclusive Activewear (and Why It’s Strategic)

- 9 Beyond Yoga Leggings as the Business Engine: Product-Led Growth Under New Leadership

- 10 Beyond Yoga Maternity Clothes: A Strategic Category for Inclusive Growth

- 11 What Yogipreneurs Can Learn From the Beyond Yoga CEO Transition

- 12 Seek Beyond: Our Take

- 13 FAQs about Beyond Yoga CEO

- 13.1 Who is the new CEO of Beyond Yoga?

- 13.2 Who is the owner of Beyond Yoga?

- 13.3 How much did Levi Strauss pay for Beyond Yoga?

- 13.4 What is Michelle Wahler known for?

- 13.5 Who is the current CEO of Beyond Yoga?

- 13.6 When did Nancy Green become CEO of Beyond Yoga?

- 13.7 What is Beyond Yoga’s connection to Levi Strauss & Co.?

- 13.8 What experience does Nancy Green bring from Athleta and Old Navy?

Beyond Yoga CEO: Who Leads the Brand Today

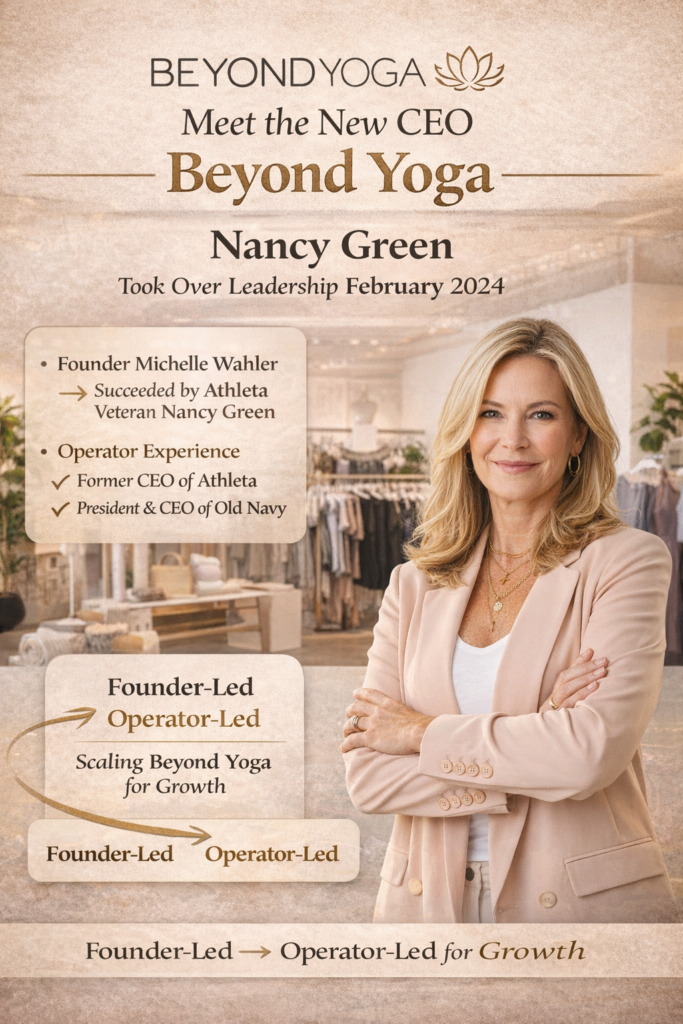

The current Beyond Yoga CEO is Nancy Green, who stepped into the role effective February 1, 2024, marking a deliberate shift from founder-led leadership to an operator built for scale. For yogipreneurs watching premium athleisure, this is less “executive shuffling” and more a sign that the brand is moving into a more structured growth chapter under a public-company parent.

Nancy Green’s appointment as Beyond Yoga CEO also clarifies the brand’s near-term focus: reaching more consumers while keeping the product promise, especially the comfort and performance reputation tied to Beyond Yoga leggings, front and center. In practice, that means scaling without losing what customers already trust (fit consistency, softness, and inclusive sizing).

That balance between scale and brand integrity is the central tension this leadership change is meant to manage. It also sets up the practical details in the quick facts below, so you can see the transition in one glance.

Quick facts at a glance (for yogipreneurs)

- CEO: Nancy Green (Beyond Yoga CEO Nancy Green)

- Start date: Effective February 1, 2024

- Replaced: Co-founder Michelle Wahler

- Parent company: Levi Strauss & Co. (Beyond Yoga has been owned by Levi Strauss & Co. since 2021)

- What it signals operationally: A shift toward repeatable scaling systems, distribution expansion, sharper merchandising discipline, and public-company-grade planning, while keeping a premium, body-positive positioning intact. This often shows up as cleaner product architecture (clear “core” vs. “seasonal”), more predictable inventory flow, and tighter execution across channels.

With the “who” clarified, the next question most readers ask is exactly when the change happened and what was driving the timing.

When Did Nancy Green Become CEO of Beyond Yoga?

If you’re searching “when did Nancy Green become CEO of Beyond Yoga”, the answer is straightforward: she became CEO effective February 1, 2024. The transition was announced as a growth-oriented move under Levi Strauss & Co., framing the role change as an intentional step into Beyond Yoga’s next scale phase.

This timing matters for business owners because it reflects a common pattern in modern retail: once a brand has proven product-market fit and built a loyal community, the constraints become operational, planning, inventory, channel strategy, and store economics. For example, a brand can have high demand for a flagship legging, but still lose sales if sizes go out of stock frequently or replenishment cycles are inconsistent.

That’s exactly where a seasoned activewear and retail executive can make a disproportionate difference, which leads into why the handoff happened when it did.

Why the CEO transition happened now

Beyond Yoga was already operating as a meaningful omnichannel brand, and public ownership tends to speed up the need for repeatable systems and predictable growth levers. Founder leadership is often unbeatable for early-stage authenticity and community resonance, but scaling a premium athleisure brand usually calls for more rigorous planning cycles, deeper retail playbooks, and more complex cross-functional execution.

In other words, this wasn’t a statement that the founder era failed. It was a sign that the brand’s complexity increased. When you’re balancing DTC performance, store expansion, wholesale relationships, and product development calendars, the operating model starts to matter just as much as the storytelling.

That sets the stage for understanding why Levi’s selected a leader with a very specific resume in women’s activewear and mass-scale retail operations.

Beyond Yoga New CEO: Nancy Green’s Background and Track Record

The Beyond Yoga new CEO, Nancy Green, is not a lifestyle figurehead brought in for brand optics; she’s a growth operator with verifiable outcomes in women’s activewear and large-scale retail. For yogipreneurs, that distinction matters because operational competence often shows up later as better in-stocks, tighter assortments, clearer product architecture, and fewer “random” launches that confuse customers.

Her career narrative also lines up with what Levi’s would logically want from Beyond Yoga inside a broader portfolio: someone who can protect a premium, community-driven identity while expanding reach through disciplined retail execution. To see why this background is so relevant, it helps to look at her best-known performance markers at Athleta and within Gap Inc.

Athleta former CEO Nancy Green: scaling proof in women’s activewear

As Athleta former CEO Nancy Green, she is widely credited with scaling the brand from roughly $250 million to $1 billion in revenue. That kind of growth is rarely accidental. It typically requires clear brand positioning, consistent product quality, and an operating model that supports repeat purchases across multiple seasons.

It also usually involves building a coherent “good-better-best” product architecture, expanding loyalist categories (like leggings, bras, and layering pieces), and improving store productivity without relying on constant discounting. Those are exactly the levers a premium activewear label must master to grow sustainably.

For Beyond Yoga, the parallel is direct: both brands live in premium women’s activewear where community and identity matter, and where product consistency is the real “marketing.” If Levi Strauss & Co. wants Beyond Yoga to become a larger women’s and athleisure growth engine, hiring someone who has already navigated that scaling path is a strategic fit.

Nancy Green is also a Gap veteran who led high-volume retail at scale, including a track record cited for growing Old Navy from $8 billion to $9 billion from 2019 to 2022. While Beyond Yoga is not a value retailer, the operational strengths that drive results at that scale, assortment planning, merchandising discipline, and execution across a complex value chain, translate well to any omnichannel apparel business.

At minimum, leaders who have run businesses of that size tend to be fluent in the operational fundamentals that keep brands healthy: inventory turns, margin discipline, clear promotional guardrails, and a tight feedback loop between customer insights and product development. Even at premium price points, those fundamentals are what keep growth profitable rather than fragile.

For yogipreneurs, the takeaway is that this type of leader tends to build systems that reduce volatility: more deliberate SKU rationalization, more consistent size availability, and clearer differentiation between core evergreen items and seasonal experiments. Those moves can make a premium brand feel more reliable to customers without making it feel “corporate,” which connects to what recent reporting suggests about her leadership style.

Leadership style signals worth noting (what recent coverage suggests)

Recent reporting on Green’s routine and CEO cadence emphasized a focus on product quality, including durability and versatility, as well as the need to stay adaptable when challenges arise. For an athleisure brand, that kind of emphasis often points to fewer short-lived, trend-only distractions and more investment in what customers actually re-buy.

That priority aligns with the business reality that your hero products, like Beyond Yoga leggings, are the retention engine, not the accessories around them. Quality leadership also tends to show up as consistent fit blocks, fewer surprise fabric changes, and more disciplined testing before scaling a style across colors and seasons.

With Green’s operator profile established, it’s equally important to understand the founder she replaced and what remains continuous from the brand’s origin story.

Michelle Wahler and the Founder Era: What Changed (and What Didn’t)

Michelle Wahler is a Beyond Yoga co-founder who served as CEO before handing the role to Nancy Green, and her imprint on the brand’s identity is foundational. For wellness entrepreneurs, this is a familiar arc: founders create the emotional core, community, voice, and trust, while later-stage leadership often formalizes the operating model needed to scale.

What changed is the title at the top; what didn’t is the need to protect the brand’s positioning as premium, inclusive, and comfort-first. Customers don’t buy “corporate strategy.” They buy how a product fits, feels, and performs, and whether the brand still reflects them.

Understanding the founder era helps explain why Beyond Yoga had enough brand equity to attract a “scale CEO” in the first place.

Michelle Wahler’s role in building Beyond Yoga into a near-$100M business

Under Michelle Wahler’s leadership, Beyond Yoga grew from an idea into a nearly $100 million omnichannel retailer, a milestone highlighted in the leadership transition announcement. That matters because it confirms the brand had moved beyond “cult favorite” status into a real operating business with meaningful revenue and multiple channels to manage.

Founder strength typically shows up as unmistakable product-market fit: customers know what the brand stands for and can describe how it feels, softness, comfort, confidence, often better than they can describe the fabric. That emotional clarity is what makes customer acquisition more efficient over time, because word-of-mouth stays strong and returning customers don’t need to be “re-sold” each season.

That kind of resonance becomes the platform an operator CEO can scale, which is why many of the most sustainable wellness brands eventually go through a similar handoff.

Michelle Wahler net worth: how to address the search responsibly

Searches for “Michelle Wahler net worth” are common, but credible public figures and verified disclosures may be limited. In responsible business analysis, it’s more useful to focus on what can be evaluated with evidence: the brand value she helped build, the acquisition context under Levi Strauss & Co., and the fact that the company reached a near-$100M revenue scale before the CEO transition.

For yogipreneurs, the lesson is to avoid confusing wealth estimates with operational reality. Ownership structure, exit terms, governance rights, and retained influence are what shape strategy, not internet speculation.

That naturally leads into the next key question: who owns Beyond Yoga?

Who Owns Beyond Yoga? Ownership, Acquisition, and Control

For anyone asking “who owns Beyond Yoga?”, the answer is clear: Beyond Yoga is owned by Levi Strauss & Co., which acquired the brand in 2021. This ownership context is not a footnote, it’s a strategic framework that influences capital access, distribution opportunities, governance expectations, and how quickly the brand is expected to scale.

In practice, a brand under a public parent company often gains resources but also faces more structured performance scrutiny. That combination helps explain why Levi’s would install an experienced scaling operator as CEO, and why the appointment is best read as a portfolio decision, not only a leadership preference.

Is Beyond Yoga owned by Levi’s? What that means in practice

Yes, if you’re searching “is Beyond Yoga owned by Levi’s”, it is owned by Levi Strauss & Co. Beyond Yoga operates as a brand inside LS&Co.’s broader organization, which means it can potentially tap enterprise capabilities like operational infrastructure, sourcing expertise, and global distribution relationships.

For yogipreneurs, ownership by a company like Levi’s can also change the rhythm of execution: more formal forecasting, more standardized reporting, and more intentional channel role definition (what’s DTC-only, what’s wholesale, what’s store-exclusive). You’ll often see sharper seasonal planning, tighter inventory targets, and clearer guardrails around promotions.

These are not inherently negative. Done well, they create consistency that protects customer trust and reduces the “boom-and-bust” cycle that can hit growing apparel brands.

Levi Strauss & Co Beyond Yoga: where it fits in the portfolio

Within Levi Strauss & Co Beyond Yoga is best understood as a strategic growth pillar in women’s and athleisure rather than a side acquisition. Reported performance underscores why: Beyond Yoga generated nearly $100 million in net revenue in FY22, which is meaningful for a premium activewear brand within a larger portfolio.

This portfolio context also sharpens the meaning of the CEO hire. A public parent company typically appoints leaders not only to “run the brand,” but to unlock growth pathways that match corporate priorities, exactly the connection that many competitor articles overlook and the one we’ll make explicit next.

What Nancy Green’s Appointment Signals About Levi’s Strategy (Content Gap / Hidden Insight)

Most coverage of the Beyond Yoga CEO change repeats the headline, Nancy Green in, Michelle Wahler out, and then lists credentials. The deeper read is that Levi’s is using leadership selection to communicate intent: Beyond Yoga is meant to scale as a women’s and athleisure growth engine, supported by enterprise resources and led by a proven operator.

For yogipreneurs, this is a practical lens: executive hires are strategy signals. When a company hires someone who has already scaled a women’s activewear brand dramatically and led multi-billion-dollar retail operations, it’s usually because the next chapter requires disciplined expansion rather than purely creative brand building.

Beyond Yoga as a growth engine in women’s and athleisure

Nancy Green’s selection suggests Levi’s sees “more upside potential” in Beyond Yoga’s authentic, high-quality positioning, echoing Green’s own statement that she sees significant upside to reach and engage more consumers. That’s consistent with a portfolio strategy that wants to grow in women’s categories and athleisure without building from scratch.

The strategic challenge will be to expand reach while keeping Beyond Yoga’s premium and body-positive identity intact. In an increasingly crowded premium athleisure market, scaling without diluting is the competitive edge, and it typically requires both tight product standards and disciplined channel expansion.

A practical example: the brand can broaden customer access via thoughtfully chosen wholesale partners or new store markets, but must maintain consistent pricing integrity and fit reliability so loyal customers don’t feel the brand “changed.”

Likely operational implications yogipreneurs should watch

Public-company-backed growth often brings a shift toward operating rigor: clearer KPI dashboards, tighter planning cycles, and more standardized merchandising processes. You may also see more intentional campaign calendars and a sharper distinction between core assortment (evergreen best sellers) and seasonal capsules designed to drive newness.

You may also notice stronger cross-functional alignment, product, marketing, and planning working from one agreed strategy, so launches look less like “a lot of drops” and more like a coherent wardrobe system. That tends to reduce customer confusion and increase basket size.

For yogipreneurs, the most important implication is that “growth” becomes measurable and system-driven. That operational reality sets up the next question: where, specifically, could expansion show up for Beyond Yoga over the next 12–24 months?

Growth Strategy Under the Beyond Yoga CEO: Where Expansion May Show Up

When leadership announcements talk about “fueling growth,” it helps to translate that language into observable moves. For Beyond Yoga under Nancy Green, the most trackable expansion levers are distribution, stores, and product/category depth, especially lifecycle-aligned categories like Beyond Yoga maternity clothes.

Because Beyond Yoga sits inside Levi Strauss & Co., readers should also expect growth to be evaluated through a portfolio lens: scalability, repeat purchase strength, and how efficiently the brand can acquire customers across channels. Those realities make distribution strategy the natural first area to watch.

Distribution expansion: DTC, wholesale, and global reach

With LS&Co. ownership, Beyond Yoga has a pathway to broaden reach beyond its direct-to-consumer base while still protecting premium positioning through selective channel strategy. Practically, that can mean clearer channel roles, stronger online conversion and retention focus, and potentially expanded access to international infrastructure, without requiring the brand to reinvent operations on its own.

A disciplined strategy might look like keeping hero products and full-size runs strongest in DTC, while using wholesale to introduce the brand through a curated assortment that reinforces “best of Beyond Yoga” rather than a diluted mix. Global reach, similarly, is most sustainable when it’s paired with the right distribution model and customer experience standards, not simply shipping everywhere.

For yogipreneurs, the key is not “more doors” at any cost, but better channel fit: maintaining brand experience, controlling discounting, and ensuring inventory health. Distribution expansion done well is less about ubiquity and more about smart access that preserves the brand’s comfort-and-quality reputation.

Retail footprint: what store expansion signals

Beyond Yoga has expanded to six stores, beginning with its first location in Santa Monica, California, in 2022. Store count matters because physical retail is often a premium positioning tool: it’s where fit, fabric feel, and community events can convert curious shoppers into loyal customers.

For wellness entrepreneurs, stores also function as marketing infrastructure, especially for yoga-adjacent audiences that value tactile experience and in-person connection. Events like local classes, styling appointments, or community partnerships can turn a store into a relationship channel, not just a transaction channel.

Watching where and how Beyond Yoga adds stores can provide clues about its customer acquisition strategy and the kind of community experience the brand wants to scale, destination retail, neighborhood convenience, or a mix of both.

Product expansion and lifecycle categories

Beyond Yoga’s growth can also come from deepening the wardrobe around its core: expanding tops, sets, lounge layers, and seasonal fabrics while keeping the brand’s comfort-first DNA intact. The most strategically aligned expansions are those that extend customer lifetime value without forcing a brand personality change.

A strong sign of disciplined product expansion is when new categories clearly connect back to the hero product promise, for example, tops designed to pair with best-selling leggings, or layering pieces that maintain the same softness and compression philosophy customers already love.

Lifecycle categories, like Beyond Yoga maternity clothes, fit this logic particularly well because they match the brand’s inclusive, body-positive positioning. That product adjacency connects directly to how Beyond Yoga positions itself in the market and why that positioning is more than a feel-good message, it’s a moat.

Brand Positioning: Premium, Body-Positive, Inclusive Activewear (and Why It’s Strategic)

Beyond Yoga’s positioning, premium, inclusive, and body-positive, is not just brand storytelling; it’s a strategic differentiator in a category where many products feel interchangeable. When customers trust a brand for fit consistency, comfort, and how it makes them feel in their body, retention rises and discount dependence falls.

For a CEO stepping into a scaling phase, protecting this positioning is as important as expanding distribution. Growth that undermines inclusivity or quality can erode the very customer trust that made scaling possible, which is why “athleisure brand leadership” often comes down to disciplined restraint.

Athleisure brand leadership without diluting authenticity

Scaling a premium athleisure brand requires operational upgrades without changing the customer’s emotional experience. That typically means protecting inclusive sizing, maintaining fit consistency across seasons, and ensuring the fabric hand-feel customers expect remains stable even as volume increases.

It also means staying close to the community voice that made the brand relevant in the first place. A common failure mode in growth is chasing every trend; strong leadership is knowing which trends can be translated into the brand’s language, color, silhouette tweaks, fabric updates, without making loyal customers feel like the brand “isn’t for them anymore.”

The best operators treat authenticity as a measurable business asset: reflected in repeat purchase rates, customer sentiment, and the strength of hero products over time.

Purpose-led messaging and “Seek Beyond”

Beyond Yoga’s 2026 “Seek Beyond” campaign reinforces continuity in purpose-led messaging, described as an invitation to “embrace the joy of the journey, whatever that might look like.” In moments like these, public-company visibility can also increase attention on annual report filings that signal how a parent company frames brand priorities and growth pillars over time.

Purpose-led narrative also helps unify product expansion and channel growth under one emotional umbrella: movement, joy, and real-life wearability. But purpose only works when it’s felt, not just said, meaning the in-store experience, the sizing reality, and the product durability have to match the message.

That brand story is only credible when the product delivers, which is why the commercial engine, leggings and fabric quality, deserves its own spotlight.

Beyond Yoga Leggings as the Business Engine: Product-Led Growth Under New Leadership

In premium activewear, the strongest brands are built on hero products that create repeat purchase and referral loops. For Beyond Yoga, Beyond Yoga leggings are not just a best seller; they are a trust mechanism that turns first-time buyers into long-term customers.

Operator-led scaling tends to amplify what already works, and leggings are the clearest “what works” signal in this category. The strategic question under new leadership is how to protect the hero-product standard while scaling volume, channels, and assortment complexity.

What makes Beyond Yoga leggings a signature (and why it matters to strategy)

Beyond Yoga leggings are commonly associated with comfort, softness, and everyday versatility, attributes that support frequent wear and high customer loyalty. From a business perspective, that matters because versatility expands use cases beyond the studio: errands, travel, lounging, and low-impact workouts, which increases the likelihood of repeat purchase.

A hero product also anchors premium pricing power when customers perceive consistent value. Customers who trust the fit are also more likely to buy multiple colors, build matching sets, and try adjacent categories like tops or outer layers.

For yogipreneurs building product lines, this is the playbook: one or two “non-negotiable” items that define the brand and make marketing easier because the customer story is simple, and consistently true.

Quality and durability as an executive-level priority

Nancy Green has emphasized product quality, including durability and versatility, which implies that quality control is not delegated as a minor operational detail; it’s an executive priority. In practice, that can translate into tighter fabric standards, more rigorous wear testing, closer supplier partnerships, and fewer compromises that lead to inconsistent fit.

For consumers, “quality” is felt in stretch recovery, opacity, seam durability, and how the garment performs after repeated washes. It’s also felt in small details, waistband roll, pilling resistance, and whether the fabric keeps its softness over time.

For yogipreneurs, the lesson is that product-led growth is operations-led: scaling requires systems that protect the product promise, especially when expansion into lifecycle categories like maternity raises the fit-and-sizing complexity.

Beyond Yoga Maternity Clothes: A Strategic Category for Inclusive Growth

Beyond Yoga maternity clothes sit at the intersection of comfort, performance, and real-life body change, making the category a natural extension for a body-positive brand. For yogipreneurs, maternity is also strategically attractive because it can deepen loyalty: customers who trust a brand during a high-stakes life phase often stay with it afterward.

The key is to treat maternity as a core expression of inclusivity rather than a seasonal add-on. That requires product integrity and operational planning that match the complexity of changing fit needs.

Why maternity fits Beyond Yoga’s brand promise

Maternity customers prioritize comfort, softness, and flexibility, which aligns closely with the reasons many consumers buy Beyond Yoga in the first place. When positioned authentically, maternity isn’t a departure from the brand; it’s proof that the brand supports women across life stages.

This also reinforces community credibility: inclusivity is not only about messaging but about offering product solutions for real bodies in real transitions. When a brand shows up for customers through pregnancy and postpartum, it builds trust that’s difficult for competitors to copy.

That alignment is why maternity can expand customer lifetime value without diluting brand identity.

What a scaled maternity line requires operationally

Scaling maternity successfully typically requires more structured fit testing, clearer sizing systems, and inventory planning that accounts for demand variability and fit sensitivity. It also benefits from lifecycle marketing that is supportive rather than salesy, guiding customers through fit, function, and styling as their needs evolve.

For example, customers may want clarity on how a legging fits across trimesters, which tops accommodate nursing, and what pieces transition well postpartum. When a brand answers those practical questions well, through product pages, store associates, and customer support, it reduces returns and increases confidence.

An operator CEO profile like Nancy Green’s suggests the brand may bring more rigor to these processes, especially if maternity becomes a deeper growth lever rather than a small capsule. Those operational lessons are directly relevant to wellness founders building products, which is why the CEO transition offers broader learnings for yogipreneurs.

What Yogipreneurs Can Learn From the Beyond Yoga CEO Transition

For readers of theyogipreneur.com, the Beyond Yoga leadership shift is a case study in how wellness brands evolve when they move from cult love to scalable business. The headline, new CEO, matters less than the mechanism: pairing founder-led meaning with operator-led systems so the brand can compete in a crowded premium market.

This is also a reminder that acquisitions and parent-company ownership change the operating environment. Understanding those dynamics helps you make smarter decisions about your own brand’s growth path, partnerships, and leadership needs.

Founder-led storytelling vs. operator-led scaling

Founders typically excel at early differentiation: they build trust, voice, and a community customers want to belong to. Operators typically excel at repeatability: forecasting, merchandising, supply chain coordination, and channel strategy that allows the brand to grow without constant firefighting.

Beyond Yoga’s handoff from Michelle Wahler to Nancy Green illustrates a clean version of this evolution. The most durable brands preserve founder DNA while professionalizing execution, which is often what’s required to scale premium products without sacrificing quality.

A useful mental model for yogipreneurs is to treat operations as a form of customer care. When your systems improve, customers feel it through better availability, clearer product choices, and a more consistent experience.

How to read executive hires as “strategy signals”

Executive backgrounds are business strategy in human form. Hiring an ex-Athleta leader and Gap Inc. operator suggests priorities like disciplined merchandising, scaled women’s activewear expertise, and the ability to professionalize growth without losing brand identity.

For yogipreneurs, this is a useful tool for competitive analysis: when a competitor hires a particular type of leader, anticipate what capabilities they’re investing in next, stores, wholesale, operational excellence, or deeper category architecture. Reading those signals early helps you position your own offerings with more intent, whether that means doubling down on a niche, improving supply chain reliability, or strengthening a hero-product story.

Practical checkpoints to track over time

To understand how the Beyond Yoga CEO transition translates into real execution, watch measurable indicators rather than headlines. Track changes in store count and where stores open, shifts in channel mix (DTC vs. broader distribution), deeper category development including maternity, and whether campaign narratives remain consistent with the brand’s body-positive positioning.

Also monitor product-level signals that reflect operational discipline: core item availability, fit consistency over time, and quality sentiment in customer reviews. Pay attention to return-rate patterns (where available), customer service feedback, and whether best sellers stay “best” because quality remains stable.

Those are the real-world outputs of leadership priorities, and they set up the most credible way to evaluate the transition: by results, not resumes.

Seek Beyond: Our Take

Nancy Green’s arrival as Beyond Yoga CEO marks a clear pivot from founder-led momentum to operator-led scale. With Levi Strauss & Co. as the owner, the brand now has the infrastructure to expand distribution, sharpen merchandising, and grow its store footprint without losing what made it resonate in the first place. The real test is execution: keeping inclusive, comfort-first positioning intact while building the repeatable systems that support predictable growth.

For yogipreneurs and brand builders, this transition is a useful blueprint. Founder energy creates trust and community; seasoned retail leadership turns that trust into durable operations, cleaner assortments, and stronger in-stocks. Watch the tangible signals over the next year: consistency in Beyond Yoga leggings quality, thoughtful category expansion like Beyond Yoga maternity clothes, and channel growth that protects premium perception. Looking ahead, results will tell the story more than headlines.

FAQs about Beyond Yoga CEO

Who is the new CEO of Beyond Yoga?

Nancy Green is the new CEO of Beyond Yoga, effective February 2024. She took over to help expand the brand into new categories and reach more customers.

Who is the owner of Beyond Yoga?

Beyond Yoga is owned by Levi Strauss and Co., which acquired the brand in 2021. It was originally founded by Jodi Guber Brufsky and Michelle Wahler.

How much did Levi Strauss pay for Beyond Yoga?

Levi Strauss bought Beyond Yoga for $400 million in 2021. The acquisition supports Levi Strauss and Co.’s push to grow in activewear.

What is Michelle Wahler known for?

Michelle Wahler is known for co-founding Beyond Yoga in 2005 and building it as CEO from an early-stage idea into a major activewear brand. She helped shape the brand’s inclusive, community-focused identity.

Who is the current CEO of Beyond Yoga?

Nancy Green is the current CEO of Beyond Yoga. She previously held leadership roles at Athleta and Old Navy.

When did Nancy Green become CEO of Beyond Yoga?

Nancy Green became CEO effective February 1, 2024. She replaced co-founder Michelle Wahler in the role.

What is Beyond Yoga’s connection to Levi Strauss & Co.?

Beyond Yoga is a Levi Strauss and Co. brand following its 2021 acquisition. Levi Strauss and Co. is working to scale Beyond Yoga with greater resources and distribution.

Nancy Green is known for scaling Athleta significantly during her time there and for leading Old Navy as it grew as a large retail business. That experience supports Beyond Yoga’s growth strategy under Levi Strauss and Co.